Empowering Financial

Freedom Across Africa

We're revolutionizing the way Africa transacts, making financial services more accessible, secure, and efficient for everyone, everywhere.

Who We Are

Nattypay Global Solution Ltd. is a registered Fin Tech company in Nigeria, committed to revolutionizing local and global financial services by providing innovative, secure, and user-friendly solutions that cater to the diverse needs of our customers. Founded with the vision of enhancing financial inclusion and empowering individuals and businesses.

Our Commitment to Excellence

At Nattypay, we are dedicated to providing cutting-edge financial solutions that empower individuals and businesses across Africa. Our platform is built on a foundation of trust, security, and innovation, ensuring that every transaction is seamless and every user experience is exceptional.We understand the dynamic needs of the modern consumer and are committed to crafting solutions that not only meet but exceed expectations. Our team of experts works tirelessly to ensure that our services remain at the forefront of financial technology, driving financial inclusion across the continent.

Our Mission

Our mission at Nattypay is to deliver cutting-edge global financial services that improve the lives of Nigerians by offering unparalleled convenience, robust security, and financial freedom. We strive to bridge the gap between traditional banking and modern financial needs, ensuring that every individual, regardless of their location or socio-economic status, has access to reliable financial tools.

Our Vision

We envision becoming the most trusted and widely used financial service provider across the globe. Our goal is to transform the financial landscape by continually innovating and expanding our services to meet the evolving needs of our customers. We aim to be a catalyst for economic growth and prosperity, helping individuals and businesses thrive in the digital age.

Our Core Values

Integrity

We uphold the highest standards of integrity in all our actions.

Innovation

We embrace creativity and innovation to drive financial solutions.

Customer Focus

Our customers are at the heart of everything we do.

Excellence

We strive for excellence in all aspects of our services.

Teamwork

We believe in the power of collaboration and teamwork.

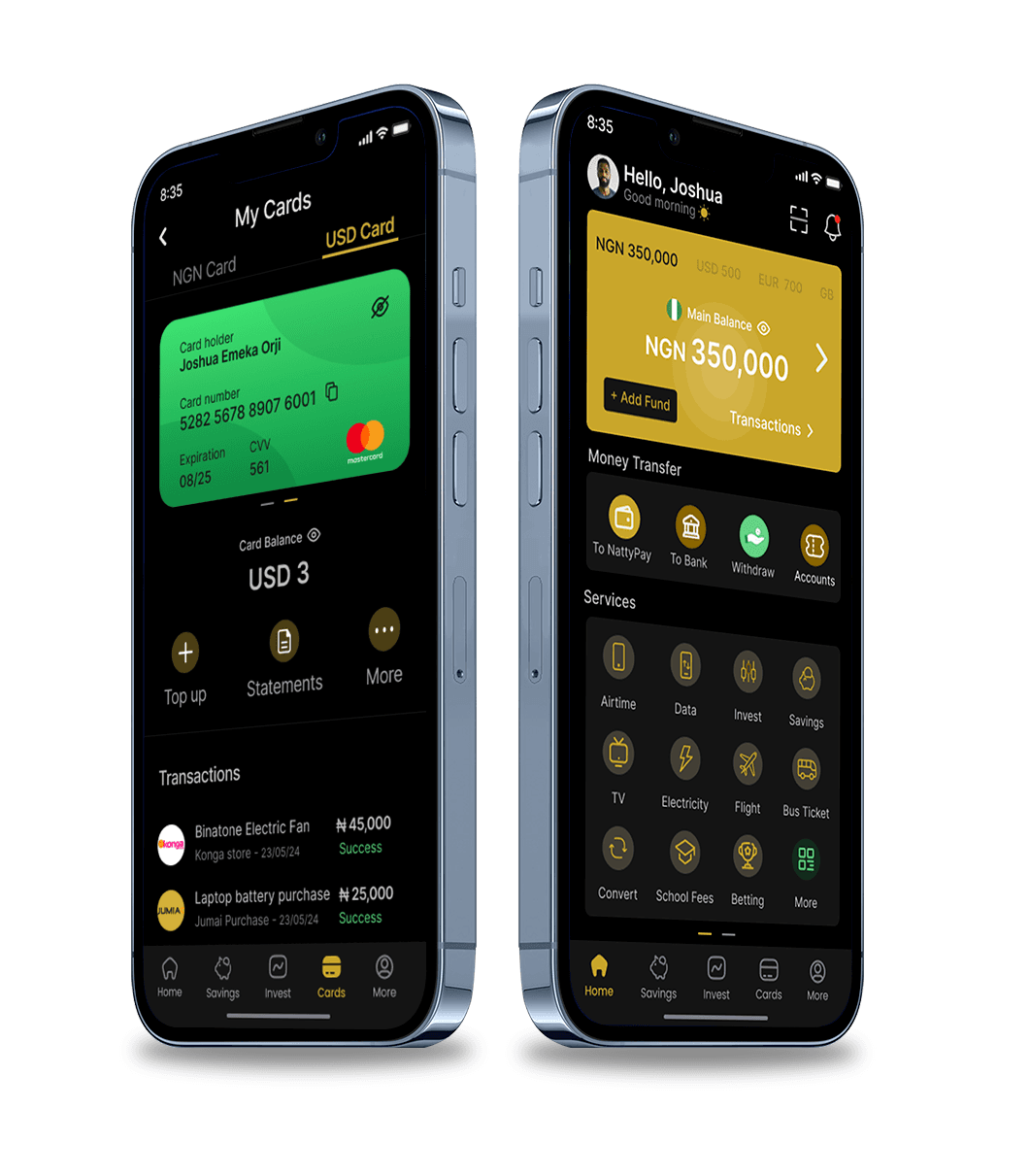

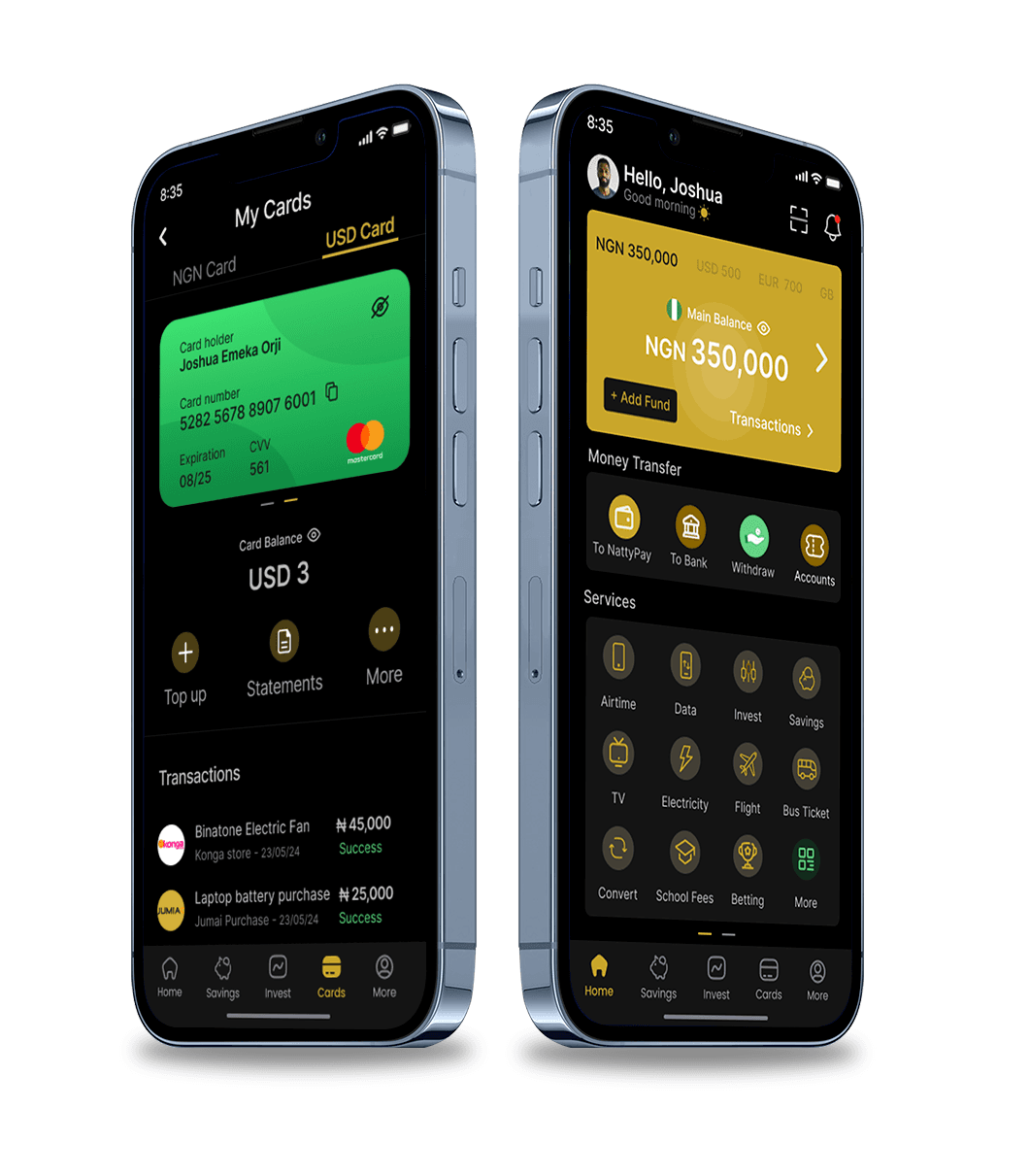

NattyPay Features

Pay all your bills at once with Nattypay without leaving your home. Whether you need to send money, pay bills, buy airtime, or manage your finances and savings, Nattypay is here to simplify your financial life.

Airtime Top Ups

Top up your mobile phone with airtime from your favorite network service providers locally and internationally

Mobile Data Top Up

Top up your mobile devices with your favorite internet subscription plans from all internet network providers

Internets

Pay for internet subscriptions from internet routers and network internet cables like Smile, Swift, Mobitel etc.

Savings & Investments

Create savings goals and track your progress. Earn attractive interest rates on your savings, and Manage your investment portfolios

Instant Transfers

Send money to friends and family instantly to any bank or physically through cash pickups. Receive funds quickly and securely.

Instant Virtual Cards

Create Naira and USD virtual cards for secure online shopping. Set spending limits and track your expenses effortlessly

Flight/Bus Tickets

Book bus tickets for intercity travel within Nigeria. Book domestic and international flights at competitive rates.

Healthcare & Insurance

Access healthcare services and purchase insurance plans. Find the best options for your health and insurance needs

Other Bills

Pay for Movie tickets, TV subscriptions, school fees, WAEC PIN, JAMB registrations, electricity, Govt fees, and many more

Try Nattypay On Your Mobile Phone for Free

Scan QR code to download Nattypay App